In Florida, a lady bird deed is a legal form that transfers property upon death inexpensively and without probate. A lady bird deed allows the current property owner to use and control the property during the owner’s lifetime, while the property automatically transfers upon death to designated beneficiaries. The lady bird deed is fully legal in the state of Florida. Pam Karlson with Karlson Law Group located in Highlands County, FL, has a series of videos on this subject posted on the Karlson Law Group Facebook Page.

ABOUT THE LADY BIRD DEED

A Florida lady bird deed is also called an enhanced life estate deed. The lady bird deed is a version of a life estate deed with enhanced powers reserved for the original owner of the property.

Requirements for Lady Bird Deeds

To be valid in Florida, a lady bird deed must include:

- Grantor. The current owner of the property.

- Enhanced life estate. The power to control the property during lifetime.

- Remainder beneficiary. The person who will inherit the property after the owner’s death.

- Legal description. A formal description used to identify the property.

- Homestead provision. For homestead properties, a paragraph that allows the owner to keep the homestead exemption.

1. Grantor

The grantor of the lady bird deed is the current owner of the property. This person is splitting their fee simple legal interest in the property into an enhanced life estate and a remainder interest.

The grantor must sign the lady bird deed in the presence of two witnesses and a notary.

2. Enhanced Life Estate

An enhanced life estate deed allows a property owner to keep control over the property during their lifetime and transfer the property upon death to a beneficiary. The enhanced life estate holder, also called the life tenant, is the person who has legal control of the property after the lady bird deed is executed. Almost always, the grantor is the life tenant.

This ownership is called a life estate because the ownership ends upon the death of the life tenant. Furthermore, the life estate is “enhanced” because the life tenant retains full power and authority to sell, convey, mortgage, lease, or otherwise manage and dispose of the property. In other words, the owner of the enhanced life estate can freely sell or mortgage the property without the permission of the remainder beneficiary.

The enhanced life estate is the key and distinguishing feature of a lady bird deed. Only states that allow an enhanced life estate can have a lady bird deed. For that reason, a lady bird deed is often called an enhanced life estate deed.

3. Remainder Beneficiary

The remainder beneficiary is the person or group of people who inherit ownership of the property upon the death of the life tenant. The legal interest of the remainder beneficiary vests when the life tenant dies. The remainder beneficiary has no ownership interest in the property during the lifetime of the life tenant.

Because the property transfers automatically upon the life tenant’s death, the property is not part of the life tenant’s probate estate. The lady bird deed avoids probate.

4. Legal Description

The legal description is the property’s formal identification in the public record. This description allows the county, future purchasers, and anyone else to clearly identify the property that is subject to the lady bird deed.

The legal description is not the postal address: it is a description of the actual land as recorded by the county.

5. Homestead Provision

Most people use a lady bird deed to transfer their homestead to their children. When doing so, it is critical to maintain the property’s homestead exemption.

To maintain the homestead exemption on the property, the lady bird deed should state that the property will remain the life tenant’s homestead.

Advantages of a Lady Bird Deed

A lady bird deed allows a property owner to transfer property upon death while avoiding probate. The deed is inexpensive, revocable, and simple compared to a trust. The advantages of lady bird deed include:

- Avoids probate. A lady bird deed allows a property to transfer on death to named beneficiaries without probate.

- Low cost. A lady bird deed can be obtained for a relatively low cost compared to a more complicated and expensive living trust.

- Simple. A lady bird deed does one thing but does it well: it transfers a person’s real property upon the death of the property owner.

- Revocable. The property owner is free to change their mind at any point during their lifetime. The property owner can enter into a new deed that gives the remainder interest to someone else or cancels the lady bird deed entirely.

Disadvantages of a Lady Bird Deed in Florida

Disadvantages to lady bird deeds in Florida include:

- Lack of Asset Protection. A creditor of the current owner may place a lien on the property, other than a homestead, conveyed by a lady bird deed.

- Constitutional Restrictions. A person cannot use a lady bird deed to disinherit a spouse or minor child.

- Unexpected Deaths. If the holder of the remainder interest dies before the life tenant dies, it may become unclear as to what happens to the property when the original life tenant later dies.

- Changes to the Estate Plan. It will require extra work for the original owner to change their plan should they later decide not to leave the property to the named remainderman.

Despite the disadvantages, people often use lady bird deeds in Florida as a simple, inexpensive way to transfer their home upon death without probate.

Lady Bird Deed vs. Life Estate Deed

A lady bird deed is different than a life estate deed. Unlike a life estate deed, a lady bird deed provides a property owner full control over the property during the owner’s lifetime.

Life Estate Deed

A life estate deed splits a property’s fee simple interest into a life estate and the remainder. The transferor retains the life estate in the property. The transferee receives the remainder interest in the property, which comprises all ownership interests remaining other than the retained life estate.

The life estate holder owns the property during their lifetime. The designated owner of the remainder (a remainderman) owns the property upon the death of the life estate holder.

If the life estate holder wants to sell the property, then both the life estate holder and the remainderman must agree to the sale. The grantor of the deed retains the right to live in the property during their lifetime, but they cannot sell or mortgage the real estate during their life without the remainderman’s consent.

Enhanced Life Estate Deed

A lady bird deed is also known as an enhanced life estate deed. An enhanced life estate deed must include (1) the name of the grantor, (2) the name of the beneficiary, (3) a legal description of the property, and (4) a reservation of lifetime rights to sell or encumber the property. If the property is the owner’s homestead, then the enhanced life estate deed must also include a paragraph preserving the homestead exemption.

The lady bird deed has the features of a life estate deed, but the life estate interest is enhanced by the ability of the life estate holder to revoke the deed or sell and mortgage the property. The enhanced life estate owner has complete control over the property while they are living. The owner can freely sell, transfer, or mortgage the property without the beneficiary’s consent.

All lady bird deeds create a life estate, but not all life estate deeds are lady bird deeds.

An enhanced life estate deed is revocable. In other words, the property owner can decide to deed the property back to themselves or to transfer the property to a third party, which effectively cancels out the lady bird deed and divests the remainderman of their interest.

Lady Bird Deed vs. Quitclaim Deed

A quitclaim deed transfers the entire fee simple interest in a property to the person named on the deed as grantee. The grantor conveys all of their interest in the property to the grantee immediately upon execution of the deed.

Unlike a quitclaim deed, a lady bird deed does not transfer the owner’s entire property interest to the grantee. A grantor of a lady bird deed retains part of the ownership as an enhanced life estate in the property during their lifetime. In other words, a lady bird deed functions as a quit claim deed that only becomes effective after death under Florida law.

Important: Sometimes a quitclaim deed may be more appropriate than a lady bird deed if the property owner wants to refinance debt and use the grantee’s credit, or if the grantee already lives in the home.

What is a Transfer on Death Deed?

A transfer on death deed (“TOD deed”) transfers property immediately upon the owner’s death without probate. This transfer-on-death feature is embedded in a lady bird deed. A transfer on death deed is often used as a will substitute as it allows people to efficiently transfer their homes to their designated heir outside of the cumbersome and expensive probate process.

Transfer on death deeds are not available in every state. In particular, Florida law does not provide for transfer on death deeds. Florida has not adopted the Uniform Real Property Transfer on Death Act, which would otherwise allow people to use a transfer on death deed for their property.

However, a lady bird deed accomplishes the same thing as a TOD deed. A Florida lady bird deed automatically transfers ownership of a property via deed upon the current owner’s death.

Example Use of a Lady Bird Deed

Sally Smith is retired and lives in her Florida home by herself. She used to own her property together with her husband, but her husband is now deceased.

Mrs. Smith has two adult children. She does not own anything of substantial value besides an old car and some money in her bank account. She wants to make sure that her house goes to her children when she dies in the easiest way possible. She doesn’t want her children to have to deal with probate or hire a lawyer just to get the home. But, she doesn’t want to give up her home while she’s living.

Mrs. Smith executes a lady bird deed for her house, naming her two children as beneficiaries. While Mrs. Smith is still living, Mrs. Smith will still enjoy full benefits of ownership and can freely live in, sell, mortgage, or transfer the home. Once she dies, however, the property will immediately transfer by operation of law to her two adult children. The children will not need to hire an attorney or probate the home.

Keep Homestead with a Lady Bird Deed

A lady bird deed in Florida does not affect the homestead character of a residence. The grantor retains homestead rights after executing a lady bird deed for as long as the grantor lives in the property.

This means two things: first, the home will remain exempt from creditor attachment, and second, it will generally qualify for a homestead tax exemption.

Using a Lady Bird Deed for Medicaid Planning

A lady bird deed can be a useful tool in Florida for people who qualify for Medicaid and who are concerned that the government will be able to take non-homestead properties after their death.

In Florida, a person’s homestead is protected from creditors with very few exceptions. Medicaid cannot look to the homestead for collection.

However, Medicaid can collect from non-homestead properties the amounts paid for care during the owner’s lifetime. Medicaid can assert a claim against assets in a person’s probate estate. A lady bird deed transfers property after death outside probate so the property is not part of the decedent’s probate estate upon death. In this way, non-homestead properties are kept out of the probate estate and are protected from collection by medical claims or any other creditors after the property owner’s death.

Important: The property owner must qualify for Medicaid during their lifetime, and the lady bird deed does not affect qualification rules.

Using a Lady Bird Deed to Avoid Probate

Probate is a legal process by which a court assembles all of a deceased person’s assets in a “probate estate,” determines if any creditors have claims against the deceased person, and then distributes whatever is left in the probate estate after paying creditors according to the person’s will. Florida law requires that an attorney be involved in formal probate. Probate is both expensive and time-consuming for a family.

A lady bird deed avoids probate because the property title automatically transfers to the remainderman by “operation of law.” The subject property is not part of the decedent’s probate estate.

Legal Basis

There is no Florida statute specifically authorizing ladybird deeds. However, the general legal consensus is that ladybird deeds are authorized under common law, particularly by the Florida Supreme Court in Oglesby vs. Lee, 73 So. 840 (Fla. 1917) and Aetna Ins. Co. vs. La Gasse, 223 So.2d 727 (Fla. 1969).

Tax Implications

Transferring property by lady bird deed does not trigger a gift tax. The transfer is not a completed gift during the lifetime of the property owner.

In addition, the beneficiary of the lady bird deed should still enjoy a step-up basis in the property. A stepped-up basis means that if the property is eventually sold by the beneficiary, the beneficiary will pay income tax only on the appreciation in value from the date when the original property owner died.

Civil Judgments

There are different considerations for lady bird deeds if a money judgment has been issued against either the current owner or the designated remainder beneficiaries.

Judgment Against Current Owner

A lady bird deed does not protect an owner’s real property from creditors, other than a homestead, if there is a recorded civil judgment against the owner. A judgment becomes an automatic lien on all real property owned by the judgment debtor in any county in which the judgment is recorded, with the exception of homestead property.

A judgment lien would automatically attach to any non-homestead property that the debtor has conveyed in a lady bird deed. The judgment lienholder could foreclose the lien on the property.

Judgment Against Remainderman (Designated Beneficiary)

A civil judgment against a named remainderman of a lady bird deed does not affect the owner’s interest in the property during the owner’s lifetime. This is true because the remainderman’s interest in the property does not vest until the owner’s death. Therefore, there is no legal interest to which the judgment can attach as long as the owner lives. Even if there is a judgment against a remainderman of a lady bird deed, the current owner retains full control over the property and is not affected by the judgment.

Tax liens are different. An IRS lien against a remainderman attaches to the property once the remainderman is named on the lady bird deed.

Title Insurance

Most major title insurance companies fully understand lady bird deeds and are not concerned about insuring the title of a property subject to a lady bird deed. Title companies should not require the signature or consent of the people listed as remaindermen (designated beneficiaries) when the enhanced life estate owner sells the property because the beneficiaries have no vested property interest.

Some smaller or less experienced title insurance companies may not understand a lady bird deed, and these companies may require the remaindermen to sign a release. Even worse, the companies may require any judgment holders against the remaindermen to release any claim of lien against the properties. These requirements stem from a lack of understanding about how lady bird deeds work.

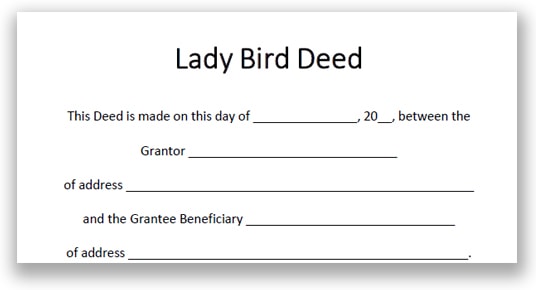

Lady Bird Deed Forms

Many online form-generator websites provide low-cost lady bird deed forms in Florida. Using one of these websites is cheaper than having an attorney prepare a lady bird deed.

A form generator website may be a good choice if you do not have any questions about lady bird deeds and know how to prepare the deed. In other cases, many people find that having an attorney prepare the deed is worth the extra costs for added peace of mind and having an expert answer any legal questions about the deed or the recording process.

Lady Bird Deed FAQs

Below are answers to some common questions about lady bird deeds in Florida.

How much does a lady bird deed cost?

A lady bird prepared by an attorney typically costs less than $350. You should expect the attorney to discuss with you the advantages and disadvantages of the deed and make sure that the lady bird deed is consistent with your overall estate plan. The attorney should advise whether your other estate planning documents are appropriate, such as a will, health care directive, pre-need guardian designation, and living will.

Is a lady bird deed a good idea?

In Florida, a lady bird deed is a simple way to have property transfer to designated beneficiaries without the expense of probate. Using a lady bird deed may not be a good idea if there are civil judgments already entered against designated beneficiaries.

Is a lady bird deed better than a living trust?

A revocable living trust is may not be required when the only property to be transferred via the living trust is a homestead. A living trust is the better estate planning option for people who have significant assets other than their house.

Is a lady bird deed legal in Florida?

Florida is one of the few states where a lady bird deed is legal. The states that offer lady bird deeds include: Florida, Michigan, Texas, Vermont, and West Virginia. Some other states may have what is called a transfer on death deed. Otherwise, property in those states must generally be put into a trust to avoid probate upon the owner’s death or else be held with survivorship rights.

Does a lady bird deed have to be recorded?

A lady bird deed must be recorded to be effective. Once the property owner executes the lady bird deed, the deed should be recorded in order to document the conveyance as part of the property’s legal chain of title. Recording the lady bird deed should not involve significant documentary stamp taxes, even if the property is mortgaged.

How do you change the beneficiaries on a lady bird deed?

A property owner can change the beneficiaries under a lady bird deed even after the original lady bird deed is recorded. The owner must execute and record a second lady bird deed that names the new person or people whom the owner chooses to inherit the property.

FOR MORE DETAILS, CALL US TODAY & LET US BE YOUR ADVANTAGE!

Main Office: 863-386-0303